The pf withdrawal form (EPF) serves as a savings instrument. The employee and the employer contribute an equivalent sum towards this savings, which can be accessed upon retirement or when changing jobs. Currently, you have various options to verify your EPF Balance Check. You can do so through SMS pf balance check number, by giving a missed call, using the EPFO app or Umang app, and via the EPFO Portal. Enabling employees to access their pf balance check facilitates effortless tracking of their savings.

- Plan their expenses well

- Avail a loan against their EPF balance

- Check the status of their PF balance

Steps to Check PF Balance?

Table of Contents

- 1 Steps to Check PF Balance?

- 2 How to PF Balance With UAN?

- 3 1. EPFO Portal

- 4 2. UMANG Application

- 5 The process to check PF Balance Offline 2024

- 6 1. SMS

- 7 2. Missed Call

- 8 How to Check PF Balance?

- 9 How to PF Balance With UAN?

- 10 PF Balance Check Using EPFO Portal

- 11 PF Balance Check Using the UMANG/EPFO App

- 12 How to Check PF Balance Without UAN?

- 13 PF Balance Check by Sending an SMS

- 14 PF Balance Check Through a Missed Call

- 15 Things to remember

- 16 Is the e-Nomination Process for PF Account Mandatory?

- 17 How to Submit an e-Nomination in EPFO?

- 18 How to Find my UAN Number?

- 19 How to Find my UAN Through my Employer

- 20 Finding my UAN Through the UAN Portal

- 21 How to Withdraw EPF

- 22 How to Withdraw pf withdrawal form Offline?

- 23 Steps to Submit Offline Application by Filling Composite Form (Aadhaar)

- 24 Steps to Submit Offline Application by Filling Composite Form (Non-Aadhaar)-

- 25 Here are some things that you need to note before you submit this form –

- 26 How to Check PF Balance without Registered Mobile Number?

- 27 FAQ’S EPF Balance Check

There are multiple ways to check your pf balance, both with and without UAN. They are listed as follows:

- Giving missed call to mobile number – 9966044425

- Sending an SMS to mobile number – 7738299899

- Using EPFO online portal

- Using UMANG mobile application

How to PF Balance With UAN?

With advancements in technology, everybody wants things to be done online, at the comfort of their homes. And why not! When you can avail of innumerable benefits without having to step out of your house, such demands are quite justified.

1. EPFO Portal

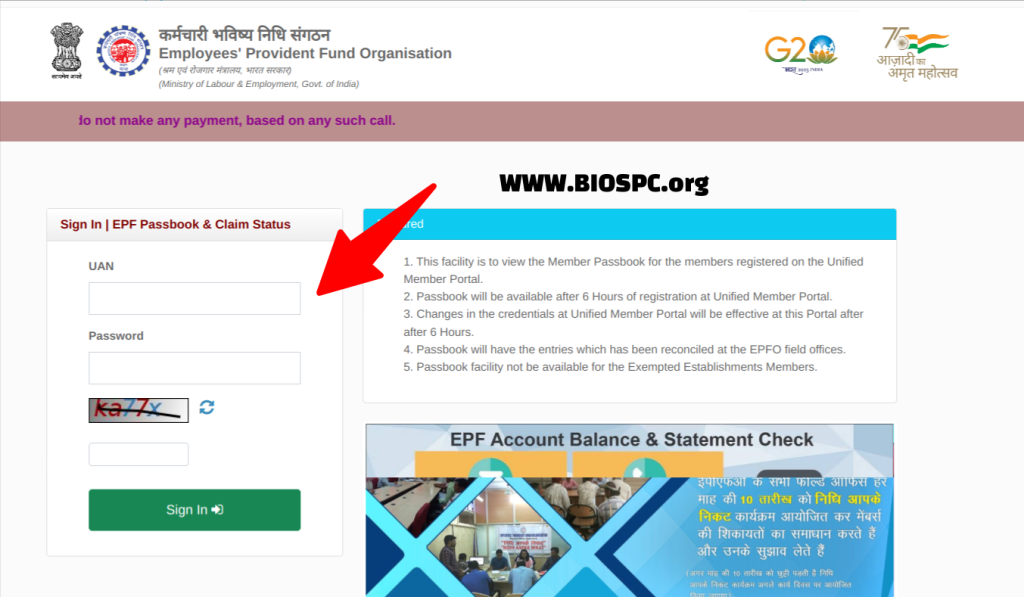

To check your EPF balance on the EPFO portal, ensure that your UAN (Universal Account Number) is activated. Once activated, follow these steps:

- Log in to the EPFO portal using your login credentials.

- Click on the “Our Services” tab.

- From the dropdown menu, select the “For employees” option.

- Under the “Services” tab, click on the “Member Passbook” option.

- On the subsequent login page, enter your UAN and password.

- After providing the correct details, you will be logged in to your EPF account.

- You can easily access your EPF passbook and view your current EPF balance.

2. UMANG Application

You can download the UMANG application, also known as the “m-Sewa app of EPFO,” on your mobile device to check your EPF balance. Here’s how:

- Open the UMANG application and look for the “EPFO” option on the home screen, under the “Employee Centric Services” section.

- Click on the “Member” and “Balance/Passbook” options.

- Enter your UAN and registered mobile pf balance check number.

- After successful verification, you can view your updated EPF balance.

- The system will display a mismatch error message if the provided UAN and mobile pf balance check number are unlinked.

The process to check PF Balance Offline 2024

For individuals not well-versed in technology, there are also a few offline methods to check EPF balance. Here’s a brief explanation:

1. SMS

If you have linked your UAN with your KYC details, you can check your EPF balance by sending an SMS in the following format to the designated mobile number:

Replace [Language code] with the first three letters of your preferred language. For example, you can use “ENG” as the language code if you prefer English. The SMS should be sent to 7738299899.

To view your EPF balance in your preferred language, you can enter the corresponding language code when sending an SMS to the designated number. Here is a list of language codes for some commonly used languages:

2. Missed Call

Additionally, you can check your EPF balance by giving a missed call to 011-22901406 from your registered mobile number. However, ensuring that your UAN is linked with your KYC details is important for this service to be available. After giving the missed call, you will receive an SMS alert containing your EPF details.

How to Check PF Balance?

There are multiple ways to check your pf balance, both with and without UAN. They are listed as follows:

- Giving missed call to mobile number – 9966044425

- Sending an SMS to mobile number – 7738299899

- Using EPFO online portal

- Using UMANG mobile application

How to PF Balance With UAN?

PF Balance Check Using EPFO Portal

To verify your EPF balance, ensure your employer has activated your Universal Account Number (UAN). The UAN is a distinctive identification number assigned to all employees registered under the EPF scheme. Employees should maintain a single UAN throughout their career, regardless of the companies they switch to. The significance of UAN lies in its role as the hub for all online EPF services. Thanks to UAN, tasks like accessing PF account services, such as balance checks, withdrawals, and applying for EPF loans, have become effortlessly accessible.

Step 1: Go to the EPFO portal. Go to the tab ‘Our Services’ and choose the option that says “For Employees” from the drop-down menu.

- Step 2: Now, click on the ” Member passbook” option under “Services.”

- Step 3: A login page will appear. Enter your UAN number and password here after it has been activated.

- Step 4: Select the ‘Member ID’ and click on the ‘View Password [Old: Full]’ option.

- Step 5: Your PF details will be displayed on the screen.

- Step 6:You can print this passbook by clicking on the ‘Download Passbook’ option.

PF Balance Check Using the UMANG/EPFO App

Workers can monitor their EPF balance using their mobile phones by downloading the Unified Mobile Application for New-age Governance (UMANG) app. Beyond just balance inquiries, this app enables users to submit and monitor claims. To gain access, members must perform a one-time registration using the cellphone number linked to their UAN.

Let’s have a look at how you can use the UMANG app to view your EPF transactions:

- Download the UMANG app from Google Play Store or App Store.

- Select the “EPFO” option listed under ‘All Services’ tab.

- Under ‘Employee Centric Service’, click on ‘ View Passbook’

How to Check PF Balance Without UAN?

PF Balance Check by Sending an SMS

Once the UAN is integrated with your KYC details, follow these steps:

- Send an SMS to mobile number – 7738299899.

- The message will be sent in the format ‘EPFOHO UAN ENG‘.

You need to specify your chosen communication language for SMS. Utilize the initial three characters of your preferred language for this purpose. For instance, if you want updates in English, use EPFOHO UAN ENG, which represents the first three characters of “English.” If you prefer updates in Marathi, input EPFOHO UAN MAR.

This facility is available in the following languages:

- English (ENG)

- Hindi (HIN)

- Punjabi (PUN)

- Gujarati (GUJ)

- Marathi (MAR)

- Kannada (KAN)

- Telugu (TEL)

- Tamil (TAM)

- Malayalam (MAL)

- Bengali (BEN)

You can inquire about your balance through SMS only if your UAN is operational and linked with your bank account, Aadhaar number, and PAN. If your UAN is not connected to these credentials, you need to complete the eKYC process with your UAN to be able to check your balance using SMS.

PF Balance Check Through a Missed Call

You can check your EPF balance by simply giving a missed call to the designated number from your registered mobile phone. However, this service is accessible only after your UAN is linked to your KYC information. If you encounter any difficulties in this process, you can seek assistance from your employer.

Once the UAN is integrated with your KYC details, follow the steps mentioned below:

- Give a missed call to 9966044425 from your registered mobile number.

- After placing a missed call, you will receive an SMS with your PF details.

You must ensure that the following requirements are fulfilled before you check your EPF balance check through missed call:

- UAN should be activated.

- Your mobile number should be registered with the UAN since the missed call facility is available only when the missed call is made from your registered number.

- The UAN should be linked with other essential documents like PAN, Aadhaar and bank account.

Things to remember

- You can check your EPF balance on the EPFO portal only if your UAN is activated and registered on the EPFO Portal.

- The facility to view the passbook will be available after six hours of registering on the EPFO Portal.

- The passbook will show the latest entries reconciled by the EPFO Field Offices.

- Exempted establishment members and private trusts cannot view their EPFO balance check.

Is the e-Nomination Process for PF Account Mandatory?

While the pf withdrawal form Organisation (EPFO) hasn’t made fore-nomination mandatory for PF accounts, completing an e-nomination for your PF account is advisable. This ensures that your nominees can access the EPF account during your demise, providing security for your loved ones.

How to Submit an e-Nomination in EPFO?

- Visit the UAN Member e-Sewa portal.

- Enter your UAN number, password, captcha code, and click on the ‘Sign In’ button.

- Select the ‘E-nomination’ option located under the ‘Manage’ tab.

- Choose ‘Yes’ to update the family declaration.

- Add family member details to the e-nomination form by selecting ‘Add Family Details’. You can add multiple nominees.

- Click on ‘Nomination Details’ to specify the total share amount.

- Proceed to ‘Save EPF Nomination’.

- Finally, click on ‘E-sign’ to generate an OTP. Submit the OTP received on the mobile number linked with your Aadhaar.

How to Find my UAN Number?

If you don’t have a registered mobile number, you will need your UAN number to find your PF balance. Your UAN number will be useful to you while withdrawing money from your PF account.

There are two ways to find your UAN number –

- Through your employer

- By visiting the UAN portal

Both of the methods are explained in detail here –

How to Find my UAN Through my Employer

This is the easiest way to find your UAN. All you have to do is check the salary slips that you receive every month. Your UAN will be clearly mentioned there.

Alternatively, you can contact your HR department to find your PF UAN number.

Finding my UAN Through the UAN Portal

Here are the steps you need to follow to find your UAN number –

STEP 1: Visit the UAN portal. Scroll down till you reach the ‘Important Links’ section. Select the ‘Know Your UAN’ option.

- STEP 2: On the next screen that opens up, enter your mobile number, captcha, and click on ‘Request OTP’.

- STEP 3: You will see a pop-up alerting you that the OTP was sent successfully. Click on ‘Ok’.

- STEP 4: Enter the OTP you received on your phone and the captcha. Finally, click on ‘Validate OTP’.

- STEP 5: On the next screen, enter your name and date of birth. You can choose to enter either your Aadhaar, PAN, or your Member ID. Then, enter the captcha, and click on ‘Show My UAN’.

- STEP 6: You will see a pop-up alert on the screen with your UAN.

How to Withdraw EPF

To withdraw your pf withdrawal form (EPF) online, you will need to follow these steps –

- STEP 1: Visit the UAN portal and enter your UAN and password. Enter the captcha and click on ‘Sign in’. You also have the option to click on ‘Forgot Password’ in case you do not remember your password.

- STEP 2: Go to the ‘Manage’ section and select ‘KYC’. This will help you check whether your KYC details, such as Aadhaar, PAN, and bank details, are verified.

- STEP 3: Go to the ‘Online Services’ section once you have verified your KYC details.

- STEP 4: Select ‘Claim (Form-31, 19, 10C & 10D) from the drop-down menu.

- STEP 5: You will see a screen with all your details, including your name, date of birth, Aadhaar, etc. Enter your bank account number on the same screen in the ‘Bank Account No. (as seeded against UAN)’. Click on ‘Verify’.

- STEP 6: The ‘Certificate of Undertaking’ is in the next screen. Click on ‘Yes’ to sign it and proceed.

- STEP 7: Click ‘Proceed for Online Claim’ on the next screen.

- STEP 8: Under the tab ‘I Want To Apply For’, select your claim type, e.g., full pf withdrawal form settlement, part withdrawal (loan/advance), or pension withdrawal.

- Please note that you will see no withdrawal option if you are not eligible for any services.

- STEP 9: Click ‘PF Advance (Form 31)’ to withdraw your money. Also, include the purpose and amount of the advance and your address.

- STEP 10: Finally, click on the certificate to submit your application. Depending on the purpose mentioned in the form, you may be required to submit scanned documents.

- STEP 11: Once your employer approves the withdrawal request, you will receive the money in your bank account. The procedure usually takes 15-20 days.

How to Withdraw pf withdrawal form Offline?

You can withdraw your PF funds through an offline application by downloading and submitting the Composite Form. That can be done in two ways –

- Filling the Composite Form (Aadhaar)

- Filling the Composite Form (Non-Aadhaar)

Steps to Submit Offline Application by Filling Composite Form (Aadhaar)

- STEP 1: Select the reason for the application, i.e., final settlement or part withdrawal.

- STEP 2: Fill in the details in the form using block letters. Mention your name, 11-digit UAN, and the 12-digit Aadhaar number.

- STEP 3: Enter your correct date of joining and leaving the establishment.

- STEP 4: Choose the purpose of withdrawal. Depending on your reason, you might have to furnish the required documents.

- STEP 5: Enter your PAN (in case you were in service for less than 5 years).

- STEP 6: If applicable, you must also submit two copies of Form 15G/15H. You will also need to mention why you leave your service, in case you opt for final settlement.

- STEP 7: Also mention your address. Finally, you can submit the form to the respective EPFO jurisdictional office.

Here are some things that you need to note before you submit this form –

- The Composite Claim Form (Aadhaar) is applicable when your complete details in Form-11 (New), Aadhar number, and bank account details are available on the UAN Portal and UAN has been activated.

- In such cases, members can submit this form directly to the concerned EPFO office, without attestation of claim form by the employers.

- Income Tax (TDS) is deducted if the service is less than 5 years (60 months).

- The total number of years you have been in service will be counted. So, if you have changed multiple jobs, it is advisable to merge all PF accounts.

Steps to Submit Offline Application by Filling Composite Form (Non-Aadhaar)-

- STEP 1: Select the reason for the application, i.e., final settlement or part withdrawal.

- STEP 2: Fill in the details in the form using block letters. pf balance check number Mention your name, 11-digit UAN / PF Account number, and the 12-digit Aadhaar number.

- STEP 3: Also mention your Father’s / Husband’s name and date of birth.

- STEP 4: Enter your correct date of joining and leaving the establishment.

- STEP 5: Choose the purpose of withdrawal. pf balance check number Depending on your reason, you might have to furnish the required documents.

- STEP 6: Enter your PAN (in case you were in service for less than 5 years).

- STEP 7: Mention your address and also attach an original canceled cheque.

- STEP 8: Finally, you can submit the form to the respective EPFO jurisdictional office after getting it attested by your employer.

Here are some things that you need to note before you submit this form –

- The Composite Claim Form (Non-Aadhaar) is applicable when your Aadhar number and bank account details are pf balance check number not seeded on the UAN portal.

- In such cases, members must get the form attested by their employer before submitting it to the concerned EPFO office.

- Income Tax (TDS) is deducted if the service is less than 5 years (60 months).

- The total number of years you have been in service will be counted. So, if you have changed multiple jobs, it is advisable to merge all PF accounts.

How to Check PF Balance without Registered Mobile Number?

You don’t need your registered mobile number every time to check your PF balance. You only require UAN and password to login and check the PF status. Check out the simple process below:

- Go to the PF passbook portal website and log in using your UAN and password.

- Choose the specific PF account you wish to inquire about and click on “View PF passbook old.”

- Observe the total employee balance and employer balance displayed in your PF account. Additionally, you can verify the pension balance in the last column of the PF passbook.

- If you want to review your yearly PF contributions, click on the “View passbook (new: yearly)” option pf withdrawal form.

FAQ’S EPF Balance Check

Yes, applying for an EPF withdrawal online is valid and simple.

After the withdrawal request has been properly submitted and approved by the employer, it takes approximately 15-20 days for the money to reach your bank account.

Under Section 80C of the Income Tax Act of 1961, contributions to the pf withdrawal form are deductible.